Revenue Based

Business Loans

Unlock the potential of your business with our flexible

Revenue Based Business Loans.

Apply now and receive capital within 24 hours.

GET STARTED

What is Revenue Based Financing?

Revenue Based Financing is a flexible funding solution where repayments are tied to your business's revenue.

Unlike traditional loans, revenue based loans adjust with your cash flow, making them ideal for businesses with fluctuating revenues.

Whether your earnings are up or down, your payments will follow suit, providing a financial cushion that grows with your business.

Benefits of Revenue Based Business Loans

Flexible payments

Pay more when you earn more, and less during slower months.

No equity dilution

Retain full ownership of your business without giving up equity.

Minimal documentation

Easy application process with minimal paperwork.

Fast approval

Get approved and receive funds within 24 hours.

Supports business growth

Ideal for businesses looking to expand without the

constraints of traditional loan repayments.

Pros and cons of Revenue Based Financing

Pros

- Adaptable to cash flow fluctuations

- No fixed monthly payments

- Fast access to capital

- Suitable for businesses with variable income streams

Cons

- Potential for higher overall cost if revenue grows slowly

- Higher interest rates compared to traditional loans

- Payments tied to revenue could strain cash flow during low-income periods

Get your revenue based business loan today!

Don't let financial constraints hold you back — secure your funding today!

Apply NowWe offer more than just revenue-based small business loans and funding options

Line of credit

Flexible access to funds whenever you need them. Perfect for managing cash flow and unexpected expenses.

Equipment financing

Invest in the equipment your business needs without depleting your cash reserves. Spread the cost over time.

SBA loans

Government-backed loans with competitive rates and extended repayment terms. Ideal for significant investments and expansions.

How to apply for revenue based business loans

- Provide Business Information: Begin by sharing basic details about your business, including your financial history, credit score, and the purpose of the loan.

- Submit Your Application: Our team will help you compile the necessary documentation, such as financial statements, tax returns, and business plans, and submit your application to our network.

- Review Loan Offers: Once your application is submitted, you will receive multiple loan offers from different lenders. Compare the interest rates, repayment terms.

- Get Funded: After selecting a loan offer, your funds will be disbursed to your business account, often within a few days.

Why Freedom Business Capital?

- Competitive Rates: Benefit from financing options at highly competitive rates, ensuring you get the best value for your business

- Expert Guidance: Our team of specialists will help you navigate the complexities of business financing, ensuring you make informed decisions.

- Customized Solutions: We offer tailored financing options that align with your specific business needs and goals.

- Transparent Process: Enjoy a straightforward and reliable service with no hidden fees or surprises, giving you peace of mind throughout the financing process.

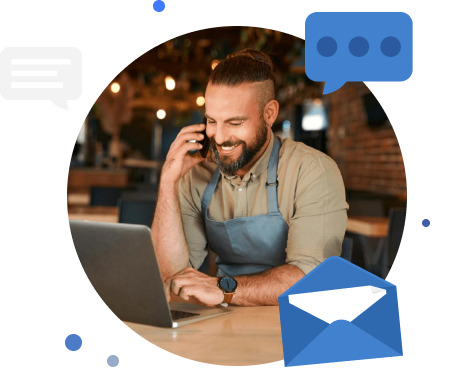

Customer reviews

Excellent

Based on 2,500+ reviews

Very impressed with NBC and the Team

We've used National Business Capital at least 4 or 6 times in the last several years and they are wonderful.

My experience with National Business...

Very impressed with NBC and the Team, This is my first experience, but it won't be my last. The fact that you communicated with the underwriter on my behalf was refreshing and it made all the difference

Great company to work with

My expernence with National Business capital has been phenomenal! Not only were they able to get me a short-term loan with better rates and terms than any of my previous funding partners, they were also able to refinance me...

Amazing!

National Business Capital at least 4 or 6 times in the last several years and they are wonderful.

Getting to know revenue based financing

How can Revenue Based Financing help expand your business?

Revenue Based Financing is an excellent tool for businesses looking to scale. With repayments tied to revenue, you can reinvest your profits into growth initiatives, knowing your loan payments will adjust based on your income. This type of financing allows you to take advantage of new opportunities without the pressure of fixed loan payments.

Understanding the criteria for revenue based business loans

To qualify for a Revenue Based Business Loan, your business needs to meet several important criteria that demonstrate its viability and potential for growth:

- A minimum of 6 months in operation: Lenders require that your business has been operating for at least six months. This period provides enough time to establish a track record and show consistent business activity, which helps lenders assess the stability and reliability of your revenue streams.

- Monthly gross sales of $15,000 or more: Your business must generate a minimum of $15,000 in monthly gross sales. This criterion ensures that your business has a solid and consistent income stream, which is crucial for repaying the loan. Lenders look at your sales figures to determine if your business can sustain the repayments, especially since these loans are tied directly to your revenue.

- A minimum credit score of 500: Although revenue based loans are more lenient compared to traditional loans, a minimum credit score of 500 is generally required. This lower threshold allows businesses with less-than-perfect credit to access financing, making it an attractive option for those who might not qualify for conventional loans. The focus here is more on your business's ability to generate revenue rather than your credit history.

- A solid business plan with projected revenue growth: Lenders will want to see a well-developed business plan that outlines your growth strategies and projected revenue increases. This plan demonstrates that you have a clear vision for expanding your business and that the loan will be used to support this growth. A strong business plan reassures lenders that you have the potential to grow your revenue, which is key to successfully repaying the loan.

By meeting these criteria, your business stands a strong chance of securing a Revenue Based Business Loan, providing you with the financial resources to support your growth and operational needs.

How small business owners leverage revenue based financing

Small business owners across various industries use Revenue Based Financing to:

- Launch new products

- Expand into new markets

- Increase marketing efforts

- Hire additional staff

- Upgrade equipment

By aligning loan repayments with revenue, these business owners can manage their finances more effectively and focus on growth.

Steps to take if your purchase order financing application is declined

If your application for Purchase Order Financing is declined, consider the following steps:

- Review feedback: Understand why your application was rejected and address any gaps.

- Strengthen your application: Improve your credit score, increase your revenue, or provide additional documentation.

- Explore alternative financing: Consider options like Revenue Based Financing, which may have different approval criteria.

FAQ

Who is eligible for revenue based financing?

A solid business plan with projected revenue growth: Lenders will want to see a well-developed business plan that outlines your growth strategies and projected revenue increases. This plan demonstrates that you have a clear vision for expanding your business and that the loan will be used to support this growth. A strong business plan reassures lenders that you have the potential to grow your revenue, which is key to successfully repaying the loan.

How do revenue based business loans compare to conventional loans?

A solid business plan with projected revenue growth: Lenders will want to see a well-developed business plan that outlines your growth strategies and projected revenue increases. This plan demonstrates that you have a clear vision for expanding your business and that the loan will be used to support this growth. A strong business plan reassures lenders that you have the potential to grow your revenue, which is key to successfully repaying the loan.

Is revenue based financing available for businesses with poor credit?

A solid business plan with projected revenue growth: Lenders will want to see a well-developed business plan that outlines your growth strategies and projected revenue increases. This plan demonstrates that you have a clear vision for expanding your business and that the loan will be used to support this growth. A strong business plan reassures lenders that you have the potential to grow your revenue, which is key to successfully repaying the loan.